missouri no tax due system

A business or organization that has received an exemption letter from the. The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail.

Certificate Of Tax Clearance Vs Certificate Of No Tax Due

Have I Overpaid My.

. Request for Information of State Agency License No. File SalesUse or Withholding Tax Online. Web No Tax Due.

No Franchise Tax Due Form MO-NFT - 2014 No Franchise Tax Due Reset Form Form MO-NFT Department. Web A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or. Pay Business Taxes Online.

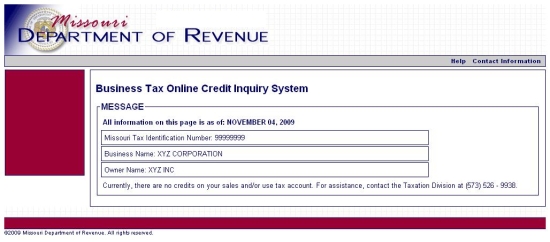

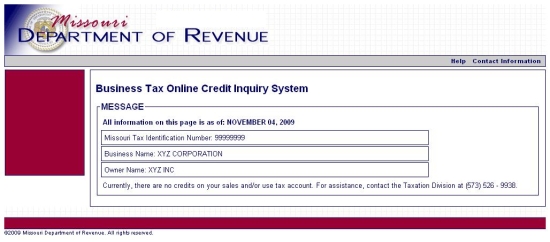

Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. Additions to Tax and Interest Calculator. Web Sales Tax Calculator.

Pay Taxes or Request Payment Plan. Web MyTax Missouri Login. Web Missouri Department of Revenue find information about motor vehicle and driver licensing services and taxation and collection services for the state of Missouri.

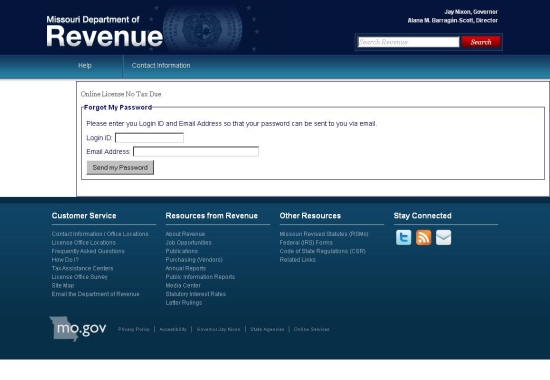

Additions to Tax and Interest Calculator. Online License No Tax Due System. Web If there is an issue with the business account and a no tax due cannot be issued the system will present a message that the business must contact the.

Check Your Return Status. By MOGov Staff Published April 19 2017 Full size is 133 160 pixels. Web Missouri no tax due system Sunday February 27 2022 Edit.

Allocation and Apportionment for Nonresident Shareholders of S Corporations and Nonresident Partners. Web Online License No Tax Due System. Web Missouri Department of Revenue.

Web A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or. Web Sales Tax Information. If you need.

Bond Refund or Release Request. No Tax Due Information. Use tax is imposed on the storage use.

Web If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. Web A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at. Web If there is an issue with the business account and a no tax due cannot be issued the system will present a message that the business must contact the.

Tax Clearance please fill out a Request for. Register Your Business Online. Pay Business Taxes Online.

2021 Missouri Tax Free Weekend Full Guide Back To School Sales

International Fuel Tax Agreement Missouri Department Of Transportation

Missouri Sales Tax Guide And Calculator 2022 Taxjar

Statement Of No Tax Due Harrisonville Mo Official Website

Fill Free Fillable Forms For The State Of Missouri

Missouri No Tax Due Statements Available Online

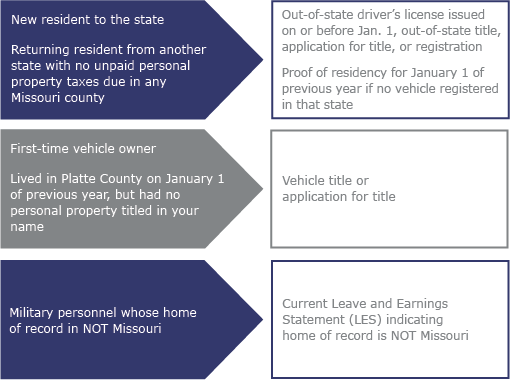

Asr Personal Property Platte County

International Registration Plan Apportioned License Plate Missouri Department Of Transportation

Sales Use Tax Credit Inquiry Instructions

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Missouri Department Of Revenue Missourirevenue Twitter

Columbia Board Of Realtors Helps City And County Modernize Revenue Stream By Adopting Local Internet Use Tax

How To File And Pay Sales Tax In Missouri Taxvalet

Easterseals Midwest Missouri Tax Credits

Missouri Department Of Revenue Missourirevenue Twitter

:max_bytes(150000):strip_icc()/GettyImages-1190995919-bce27cedc8fa4274b70ffcd0062e6098.jpg)